Retiring as a millionaire is not as hard as you may think. Our wealth calculator was designed to help you pinpoint how your current investing patterns will affect your savings at retirement. In our conversations about long-term investing with our users, there was an overwhelming curiosity about retiring as a millionaire.

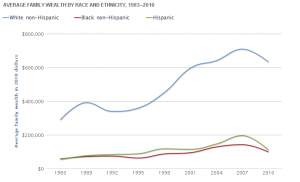

Let’s take a look at the current billionaire landscape. Of the 1,645 billionaires who made the Forbes 400, only 9 were black. Unfortunately, Oprah was the only American and woman on the list. To make matters worse, African-Americans make up 13 percent of the U.S. population, but only account for 2.7 percent of total wealth compared to 90 percent of whites according to the Federal Reserve. And according to 2011 census data, the net worth of the average black household in the United States was $6,314, compared with $110,500 for the average white household.

Investing in the  stock market can dramatically impact a person’s net worth over time. Let’s see what happens if Oprah Winfrey, Daymond John and LeBron James were to invest a percentage of their earnings in the stock market. How much passive income could each of these moguls generate over time? And more importantly, how can you as a new investor pull important lessons from these celebrities to reach millionaire status in retirement.

stock market can dramatically impact a person’s net worth over time. Let’s see what happens if Oprah Winfrey, Daymond John and LeBron James were to invest a percentage of their earnings in the stock market. How much passive income could each of these moguls generate over time? And more importantly, how can you as a new investor pull important lessons from these celebrities to reach millionaire status in retirement.

Oprah Winfrey

Oprah Winfrey’s current net worth is $3 billion. This self-made billionaire began her empire on television with “The Oprah Winfrey Show,” where she profited $30 million in the first season. Winfrey was able to captivate millions for 25 seasons with her exclusive interviews, book club, and of course her “favorite things” segment.

Annual returns are in the millions for O Magazine and her Sirius XM radio show, but the dedication she displayed in 2013 to save her once struggling network OWN continues to pay off. She landed major interviews with Whitney Houston’s family after her untimely death in 2012, followed by Lance Armstrong’s admission to doping —both interviews boosted network ratings dramatically. This decision to invest in OWN largely due to the lessons she learned from selling Oxygen Media to NBC Universal in 2007.

“As we all know, that didn’t work out for me,” said Winfrey. “It was a great lesson for me: don’t partner when you’re not allowed to be in charge and make a decision.”

If Oprah, 60, were to save 20 percent of her estimated $3 billion, she could see a return of more than $1.5 billion in just 10 years. Although the philanthropist, actress, producer and publisher has a number of investments including her successful spin-off stars Dr. Phil, Rachel Ray, and Dr. Oz, you can see how just saving a percentage of her wealth generates massive returns.

Oprah’s Lesson: Do it yourself.

Stocks will take time to understand but wouldn’t you agree it is a valuable lesson to learn? Oprah maintained ownership of OWN so she could control and shape the future with absolute clarity on what needed to happen. Using her lesson, we recommend that you conduct your stock market research yourself so you know and more importantly, when to cut losses and make new investments in the market.

This is a valuable lesson for yourself, but even more when you look at how doable millionaire status is or the next generation. Using our Wealth Calculator, imagine what could happen if you started retirement accounts for each of your children.

Daymond John

Most people watch Daymond John on the ABC hit show “Shark Tank” where he regularly competes to invest in innovative ideas against Mark Cuban, Kevin O’Leary, Barbara Corcoran, Robert Herjavec and Lori Greiner. The FUBU founder is a Brooklyn native whose journey started making T-shirt designs for rappers in his area.

“I’d give them a shirt to wear on stage, sneak in their trailer, steal it and give it to another rapper,” said John.

In 1993, LL Cool J agreed to wear John’s designs for a promotional campaign that boosted the credibility of the brand, eventually leading to $350 million in annual sales and more than $6 billion in global sales. Success did not come until after he was denied a loan 27 times and his mom had to mortgage her house to give her son startup capital. Talk about perseverance!

Now, this fashion mogul has accrued a net worth of $250 million. If he invested 20 percent of his earnings into the stock market, John could see returns of more than $550 million over the next 25 years.

Daymond’s Lesson: Invest for the long haul.

Perseverance will be critical to your success in investing. Use our Wealth Calculator to test different investment scenarios that fit your unique financial situation. Play around a bit, and test out various scenarios to determine what monthly savings strategy you need to meet your long-term financial goals.

Once you have developed your investment strategy, only you will know what is best for your stocks despite some experts urging you to sell when the market fluctuates. Daymond’s strategy to invest in rappers paid him dividends over the long haul, what will yours be? Seek companies that continue to remain innovative and have proven itself time after time. And then remember to persevere through the tough times (market down-turns) and stick to your monthly investment goals so you can come out on track for wealth in retirement.

LeBron James

LeBron James is the third highest paid athlete in the world at $72 million, only behind Floyd Mayweather and Cristiano Ronaldo as of June 2014. He has managed to rack up $53 million off the court through endorsement deals with Nike, McDonald’s, Coca-Cola, Upper Deck, and many others. James, also part owner of Beats, profited from Apples’ $3 billion acquisition of his company this past May.

Let’s just say James wanted to retire at age 40 just like the great Michael Jordan. If James invested 20 percent of his $72 million, he could make an extra $40 million in just 11 years, assuming a 10 percent average growth in the market.

LeBron’s Lesson: Diversify my portfolio.

Only time will tell if Kevin Love, Kyrie Irving and LeBron James are a return on investment for Cleveland, but it is safe to say LeBron is well on his way to earning millions more before retiring from the NBA. He has endorsement deals across numerous sectors and continues to add more each season. This same concept remains true for your personal portfolio; make sure you are balancing more volatile sectors like Technology with safer sectors like Industrial Goods. Look at diversification as an essential part of your goals for long-term wealth building.

Looking at Your Long-term Financial Goals

Each of these moguls excelled in their craft with hard work and perseverance. Daymond John tested his market by selling hats, Oprah Winfrey transformed daytime television with her talk show, and Lebron James continues to headline conversations of NBA greats before reaching age 30. But we all must remember that investing is critical to financial security upon retirement. And keeping a hands-on approach to regular, diversified investments is one of the surest paths to wealth in retirement.

Join others across the nation like yourself taking our “Start Now: Investing in Your Future” education series to learn the basics of investing to ultimately close the wealth gap.

“Save as much as you can. Most people don’t save enough, especially when they’re young. Save 30 percent to 40 percent of your income if you can. Live efficiently so you can put a lot of money away; that can provide multiples of happiness in the future.”

— Jon Stein, CEO of Betterment.

Are you ready to apply these lessons on your journey to financial security?