Do you have multiple purchases you’re trying to save for? If you’re like most, saving for retirement is a given, but you have things that you want in between now and then. Budgeting for big purchases, like a new house or new car, absolutely require planning. But even just trying to save for a splurge, or saving for something like an online course or class, can be much easier if you plan ahead. Getting started on these range of goals can be daunting, so we developed a new Goal Planning Tool, and a guide to getting started.

First Step, Understand What You Want and Why

Most financial planners dive right into setting a savings goal and then socking as much money away as possible until you reach it. To me, that’s a bit rash. First of all, before you go into all that effort and opportunity cost, you should get really clear on what you are saving for, and the most important reason is why! Let’s use the new car example; what will a new car do for you? Here are some examples:

- a new car will be less expensive overall because your current car has high maintenance costs

- a new car will be safer and more reliable because current car has broken down roadside before, and you need your car for work

There are no good or bad reasons, just reasons. But, get clear on why you have the savings goals you do. Here’s one question that will help you visualize your goal happening: How will I feel when I achieve this goal?

Then, Define SMART Savings Goals

Do you know what you are really saving for? How much would a house really cost, what kind of car really suits your needs? So that you’re not spinning your wheels (sorry, pun intended), it’s time to create some clearly defined savings goals. I prefer the SMART goal method – we’ve talked about it previously here – but let’s recap in light of a savings goal:

- Specific: A smart savings goal has a specific amount that you need to make the purchase.

- Measurable: This may or may not be easy to achieve depending on what your savings vehicle is. Regardless, you do need to make sure you can do the math on your savings vehicle’s potential.

- Attainable: Can you actually save enough to reach your goal? Is the goal realistic?

- Relevant: This goes back to the first step – does this savings goal truly support your desires and needs?

- Time-Bound: You can go about this two ways; one is to ask, when do you need it? (I need a new car before winter weather begins.) Or, you can decide how much you can save each month, and then do the math on how long it will likely take to get to your goal.

Finally, Put a Savings Plan into Action

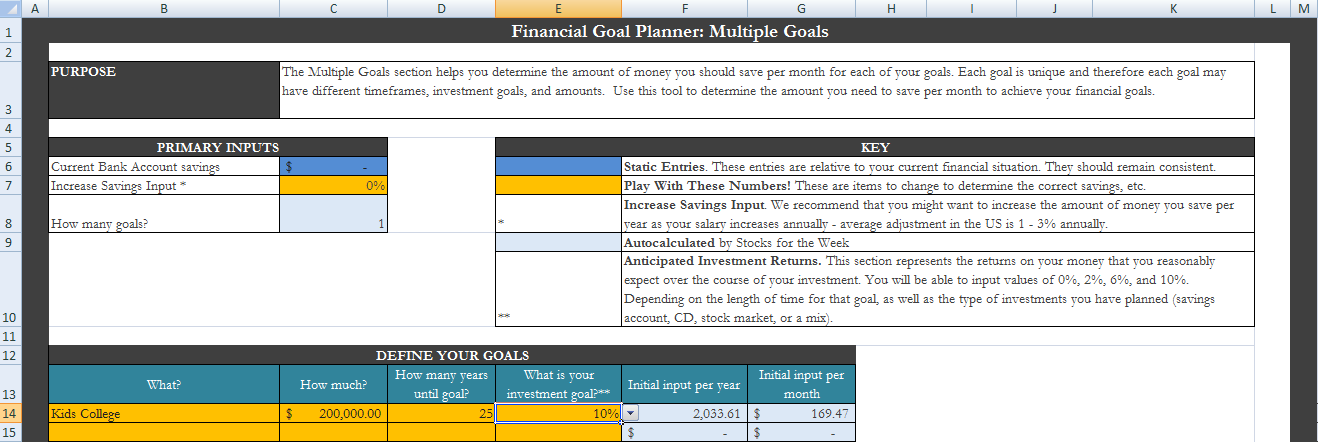

You might have noticed in detailing out the SMART goals, there was a lot of “doing the math.” And if you’re like me, doing math about savings doesn’t sound like very much fun. That’s why we created the FREE Ultimate Financial Goal Planner. This comprehensive worksheet helps you create goals, detail out a savings plan that is realistic & achievable, and then stay on track to gradually save for that dream house, wedding, or new business nest egg, while also allocating money toward retirement, and still having money left over to enjoy your life today.