This weekend I read a book by the surgeon Atul Gawande called The Checklist Manifesto. In essence, the author highlights a variety of case studies illustrating how something as simple as a checklist can help improve performance – and in the case of surgery, improved performance means saving lives!

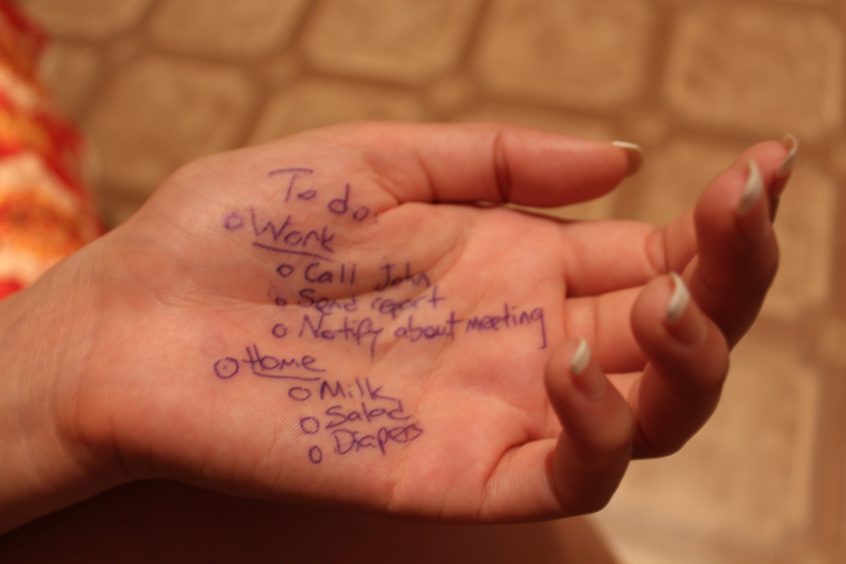

It got me thinking about how powerful a “wealthy mindset” checklist could be to helping folks maintain their good credit, staying on top of debts, and building assets for their future. So I thought I would make one!

This is just a start, and I’ll update it here regularly, but print this out and see how you’re doing in building a wealthy mindset.

Monthly Checklist

Use this checklist as part of a monthly “finance date.”

- I have paid the minimum off of any debts due this month (credit card, student loans, mortgage) and paid extra where possible.

- I have a budget and have reviewed my spending this month against the budget.

- I have reviewed my bank statements this month and reconciled all activity.

- I have put money into my retirement fund, emergency fund, and savings account.

- I have taken care of my physical health (drinking enough water, eating well, getting enough sleep, exercise) – and using health savings account [HSA] money where needed.

- I have read books/articles or listened to podcasts to help increase my knowledge of building wealth and self-improvement.

- I have taken time to relax and recharge.

Annual Checklist

Review this one at the end of the year and then a final check when you file your taxes.

- I have maximized my contributions to my retirement fund(s) – 401k, IRA – including taking advantage of employer matching.

- I have reviewed my recurring bills – such as insurance, cable, phone, etc. – and taken time to see if I am getting the best deal.

- I have reviewed all of my debts and understand where I am and have been making headway on a full payoff.

- I have checked my credit report and attempted to correct any incorrect information or made a plan for improving my score.

- I have reviewed my retirement portfolio and considered any changes to ensure the portfolio is balanced and diversified.