Ultimate Financial Goal Planner

Tools & Tricks for the Ultimate Financial Goal Planner!

The Ultimate Financial Goal Planner is meant to help you take incremental and regular steps toward each financial goal, while still keeping in mind the longer goals too. This means don’t forget retirement on the way to buying a house! It is important that you include the short- and long-term goals within the plan to ensure that you are saving the right amount of money along the way!

If you haven’t downloaded the Goal Planner yet, that’s here. Once you have it downloaded, then you are in the right spot for additional information on how to use this powerful tool!

The Goal Planner can look quite complex when you first see it. Don’t let this deter you! In this piece we explain each input area to help you pick the right numbers that will help you reach your short- and long-term goals. With just a few quick explanations, we can help you get this powerful savings plan working for you.

What Does the Planner Do?

There are two key sections in the Ultimate Financial Goal planner. The first section is an advanced version of our Wealth Calculator. This tab within the Planner personalizes your calculations for Wealth and retirement savings, such as 401K/ 403B plans. The Advanced Wealth Calculator tab helps you determine the amount of wealth you will have accumulated for retirement based on your savings plan.

The second section is a Multiple Goals Savings Tool. This tab will help you determine how much money you should save per month so you can reach each of your long-term savings goals. We’ll review each of these tabs separately below so you can effectively use our Ultimate Financial Goal Planner.

Advanced Wealth Calculator

To better see a projection of your future wealth based on your current habits, you will need to detail a few key items in this section of the Goal Planner. Again, it’s easiest if you download your own copy and follow along

Step One

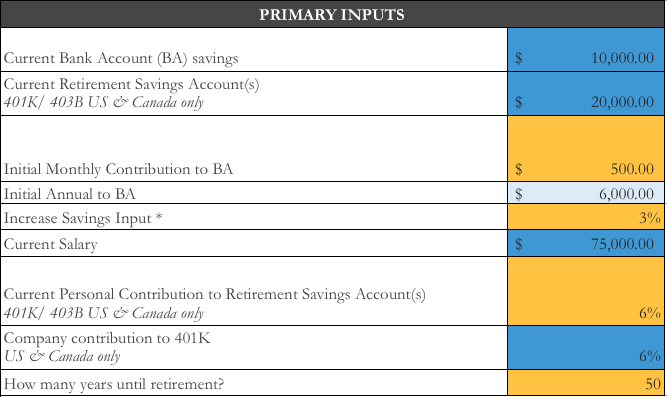

First, complete your static entries within the Primary Inputs section of the sheet. These are the sections that are current facts about your financial life. We’ll cover the blue sections first

How much money do you currently have in your savings account that you can contribute toward your goals?

Input that here in Current Bank Account. This money should be the savings money you have after your rainy day fund. The rainy day fund is the average amount of money you spend in three months, meaning that if you were out of work for three months you would still be able to sustain your lifestyle until you found alternative employment. If this number is zero right now that is OK, now is the perfect time to start a savings goal for it, which we’ll cover on the second tab!

Now, how much money, if any, you have in any Current Retirement Savings Accounts? Include 401k and 403B here:

These are usually accounts set-up by U.S. based employers for retirement savings. You may have more than one account if you have transitioned jobs without consolidating your accounts. Use the number that best describes your retirement savings accounts, if the number is $0 or $100,000. Once again, if this answer is zero that is OK. We’ll just set up in the Multiple Goals Savings Tool part of this Planner.

Enter your Current Salary:

This information helps drive the understanding of your current 401K and 403B contributions, if needed.

Document your Company contribution to 401K:

If you do not have any company contribution please input 0%.

Step Two

Now we’re moving into the gold sections.

Evaluate your monthly contribution:

Assess how much money you can add to your bank account savings, and input that for your Initial Monthly Contribution to BA. This amount can be adjusted as you determine how much you may need to save to meet your future wealth goals.

Calculate your annual increases :

Now navigate to the Increase Savings Input. Here you will enter the percentage you want to annually increase monthly savings contribution to your bank account (BA). For many of you, your salary will increase annually due to both cost of living adjustments and merit-based raises. As your salary increases, so should the money you put toward your savings. The average annual Cost of Living Adjustment is between 1 – 3%. What percentage will you increase your savings input annually? No matter what you decide, it’s a great starting point and put that in Increase Input Savings. Go ahead and fill in the remaining sections with your personal details.

Determine your Current Personal Contribution to Retirement Savings Account (your 401K/ 403B):

This contribution percentage might be something you choose to alter after viewing the results of this advanced wealth calculation exercise.

Estimate your retirement age:

Guess the number of years you will work before you retire and input that into “How many years until retirement?”. This is also a primary input you can adjust help determine your financial readiness at varying stages of your life.

Step Three

Now you’re ready to play with some of those variables and see how small tweaks to your savings situation can have a large impact on your goals. Seeing the effect of annual raises may just motivate you to ensure you’re asking for your merit-based raises when they are due. Or try adjusting your retirement age to see what an extra five years does to your goals.

1) Name the goal – be specific as you need to remember

2) Input how much you are trying to save

3) Estimate how many years until the goal will occur

4) What rate you plan to invest this money – similarly, to our Wealth Calculator you can choose to invest your money at different rates and visually see the effects of investing your money. Using historical returns for the S&P 500 and returns for savings accounts, CDs, bonds, etc., here are a few examples that should serve as guidelines only. We do not guarantee returns. Use these estimates as just that—an estimate.

0% – the rate you’ll earn keeping this money in your mattress (or your checking account)

~2% – the possible rate from investing in CDs

~5% – the possible rate from mixing various forms of investments and savings.

~7% – the stock market return for the last 10 years

~10% – the stock market return for the last 20 years

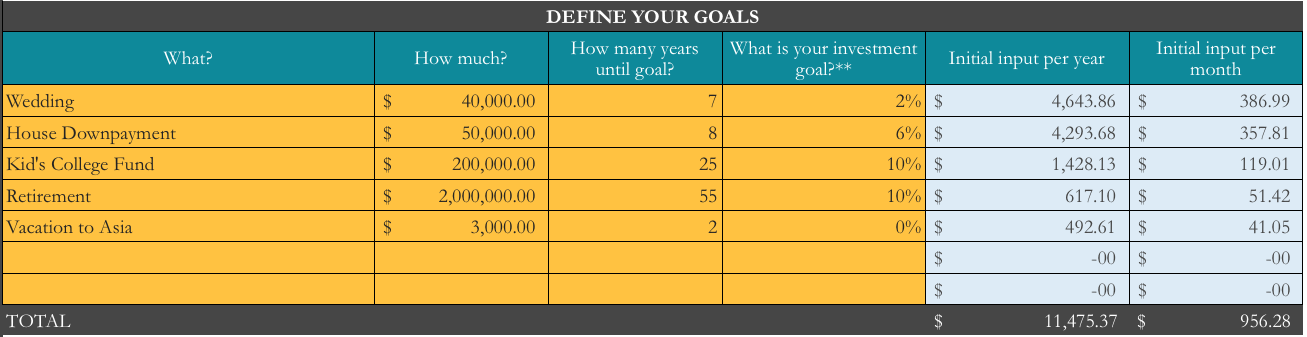

You can write as many goals as you want and the Goal Planner will auto populate the amount of initial savings per year and also per month. Let’s look at an example

Let’s break it down.

In this example, I am saving for five specific goals. I plan to retire in 55 years with $2 million dollars. Before retirement, I hope to: have money for wedding in seven years, savings for a house down payment in 8 years, send my future children to college in 25 years, and buy afford a vacation to Asia in two years.

For each of these goals I will choose different investment goals (fourth column in the “Define Your Goals” section).

For my goal ten years away, my house downpayment, I will invest this money in a mix of savings account and stocks, which at historical stock exchange rates should return something in the 6% range. This is a best-guess, but a decent estimate for how I plan to invest and save that money over the next decade. So, I entered 6% for that goal’s “What is your investment goal?” For my other goals, which are more long-term, I will be investing with various degrees of risk depending on their timeline. Picking that timeline is highly personal, but we recommend anticipating 2 – 6% for most medium to long-term goals, more on that decision process here. Sites like Betterment and Wealthfront are also great for where to actually keep your money for each goal as they have fantastic risk assessment criteria to help you make the right mix of stocks and bonds.

As you can see, to reach all of these goals I will need to save just over $1,100 a month. If this assessment doesn’t work with my current financial situation, or if I can afford to put away more each month, then I can re-evaluate if I want to invest more for my child’s college education fund in order to see higher returns since that is a long-term 18-year goal. This is when you can tweak, adjust, and play. We recommend playing with these numbers, adjust them higher and lower, give yourself longer to save, etc. Then watch how your monthly contribution shifts too. By looking at your goals in tandem, you are able to see the powerful way compounding interest can positively affect your long-term goals.

Now it’s your turn! Try out these key questions as you are walking through the Goal Planner

- What financial goals do you hope to achieve for the future?

- What is the amount of money you will need to achieve them and when?

- Based on their timelines and your comfort with risk, do you plan to invest to achieve these goals?

- Do you believe the saving inputs per month are achievable?

- After you see the outcomes for your first set of goals, did you change any of the amounts or any of the investment percentages?

Additional Help With Common Challenge Areas

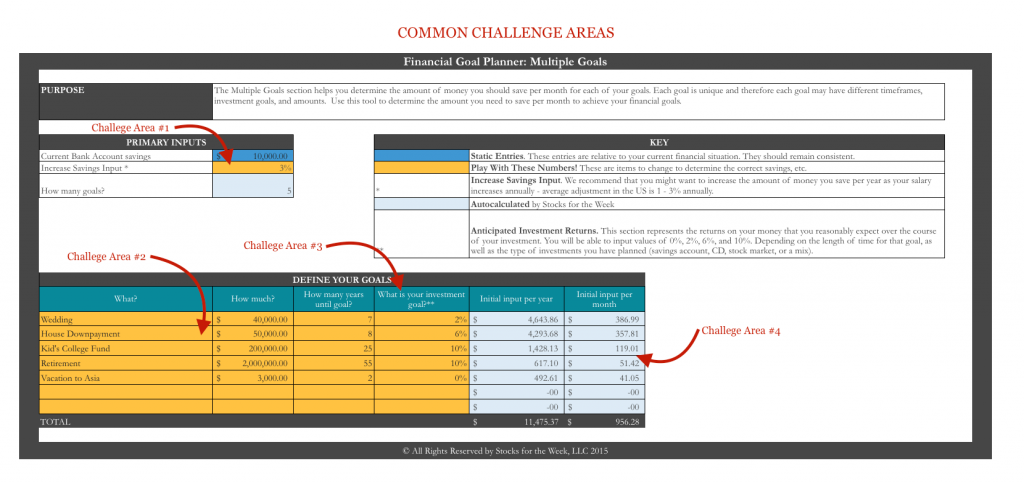

Challenge Area #1 – Annual Input Increase

For the key inputs, the most challenging is the input for the Increase Savings Input, that amount of extra amount per year that you want increase your savings goals. As for all inputs with the Goal Planner, you can change this! If you are new to the workforce or you have a job with low annual increases, then choose a lower input increase, such as 1%. If you are in a high-growth profession then you may choose as much as 3% annual increase (fractions work as well if you think you’re likely at about 1.5% annually!). We highly recommend that you commit to some increased amount per year as your salary is likely to increase annually and your savings goals should reflect that too. Many young savers get caught with the challenge of earning more money in their jobs and not translating part of those earnings into higher savings. If you commit to annual increases in savings now it will make it easier to stick with it later!

Challenge Area #2 – Goal Selection

If you are having trouble selecting some goals, don’t feel alone. Selecting your major financial goals for next few decades can be daunting, but remember that this is a tool for you to use. You can continue to add new goals as you determine them. To get started, think of just two goals. For most people, retirement is an easy goal to have as the main first goal. The second goal could be a your safety fund if you don’t have one yet, or other goals like: vacation, house purchase, education, child, wedding, etc. We think goals are so important that we wrote an entire piece on the the most effective ways to set and act on goals.

Challenge Area #3 – Investment Goals and Risk

Alright, time to choose an investment goal for each personal goal. Before we choose this percentage, however, you should understand and assess the risk for each of your goals — that’s how you’ll know what to enter in this field.

Think about it like this. For goals that are less than five years away, you will need the money accessible and ready to withdraw so you can achieve that goal, which means those funds are not good candidates for investing. You may choose a low-interest savings account for those funds, or a CD.

For goals medium-term goals, those that are 5 – 10 years out, many consider putting funds in several types of investments, with a possible mix of bonds, CDs funds, and stocks. Ultimately, only through personal research will you know what is right for your situation and goal.

For goals longer than 10 years, you should assess your personal risk level and your knowledge of the stock market. Many retirement accounts invest heavily in stocks when you’re still far from retirement, and these accounts can only anticipate on historical stock performance for predictions.

In practical application, that may mean these guidelines for your investment goals:

- <5 years — 0% or 2%

- 5 – 10 years — 2% to 6%

- >10 years — 5% to 10%

We do not guarantee returns. Use these estimates as just that—an estimate. At this planning stage, these choices are only guess based on your future investment decisions. Try out different percentages and see what the right fit is for you, and start learning more about investing and risk with these recommendations. We also recommend these posts for additional research on historical returns:

Challenge Area #4 – Implementation of the Goals

Now that you have designed your goals, it’s important that you assess your goals to make any changes as needed. As we mentioned before, start with these two questions:

1. Do you believe the saving inputs per month are achievable?

2. After you see the outcomes for your first set of goals, did you change any of the amounts or any of the investment percentages?

One are you are comfortable with your goals, it is time to take the tangible steps to implement these goals.

For goals that don’t involve investing to achieve (those shorter-term goals), consider creating a second savings account that is separate from your general savings account. Then, set up an auto-transfer to this secondary savings account with your monthly input for those goals. Then, you never have to miss a payment toward your savings goal.

For investments, you can auto-transfer into your investment account. Whether it’s Betterment, Wealthfront, or Charles Schwab, automatic monthly investments are important. You should consider setting your input amounts to automatically deposit them after each paycheck to ensure the money is going toward the correct goals! As a Betterment user, you can also check out the risk feature that shows how much of your money is going into stocks and bonds. This is another great way to help you personalize your account returns and understand your risk!

Now the trick is to use this Goal Planner regularly — check in on your goals and make sure you are on track. Or, adjust them if you have some life setbacks and chart out a new course toward financial success. We recommend you set an annual financial date, more on that here.