You’ve no doubt used our free wealth calculator app, which is focused on reaching your retirement ‘nest egg’ dreams.

But what if you’ve got multiple financial goals you’re trying to juggle? Firstly, we hope you are focused on SMART financial goals. But, once you’ve got your goals down on paper, let’s get planning. Here are 3 things you need to do in order to plan for multiple financial goals (without going crazy).

1. Get clear on how much you really need for each goal (and any wiggle room there is).

What we’re saying in this step is basically do your homework. Pencil out in detail how much you really do need for your financial goal. Some examples:

- You want to have a 6-month emergency savings fund. How much do you spend on essentials in 6 months?

- You want to buy a house within 2 years. How big of a house? What features are must-haves? Based on that – what are houses running? And what do banks want for a down payment? Lots. of. homework.

- You want to buy a new car next summer. Lease or buy? What is a typical down payment? Would your fuel & maintenance expenses go up or down?

See how every goal tends to unravel a dozen or so questions? Take your time to work through them, one at a time, until you feel confident about the amount your financial goal should be.

2. Get a plan written out.

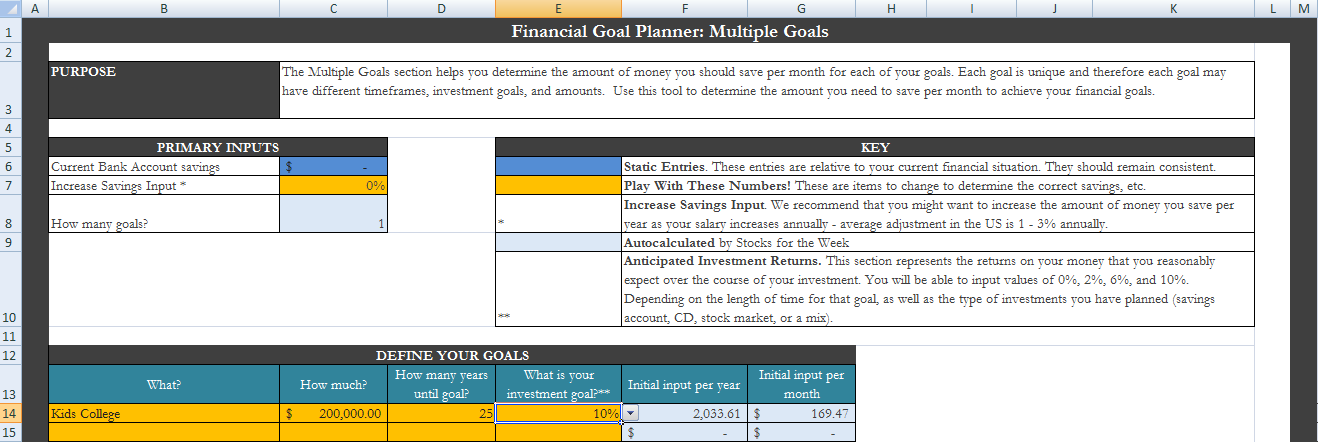

That might sound like an “easier said than done” statement, but we’ve got you covered with one of our free downloads, the Ultimate Financial Goal Planner. With this spreadsheet, you can map out the when, how, and how much for each of your financial goals.

You might find with this tool that some of your goals are easier than you thought! Or you might realize you need to prioritize your goals and that you can’t do everything at once.

No matter the outcome, the important part is in the knowing, because the sooner you start planning it out, the sooner you can start to realize your goals.

3. Take action, consistently. Keep the plan updated.

Following your plan is the final step; sounds easy, but it’s one that people often overlook. You need to follow the plan, consistently, until you reach your goals.

Plans change – and so do your goals, so don’t forget to update the plan as needed, and adjust your spending and savings habits accordingly. Depending on your goals, you might want to review your goal planning worksheet at least once a quarter, if not each month if you want to really stay on top of your monthly incoming and outgoing funds.