At one of our recent focus groups reviewing our popular wealth calculator, one question came up several times: how do I use the wealth calculator to estimate how much my 401k will be worth at retirement?

Let’s take a moment and walk through it.

Gather Your Information Up Front

One of the reasons the wealth calculator is so useful is perhaps that it requires you to answer some difficult questions. If you’re wanting to use the app to calculate your 401k potential, here’s what you’re going to need to know:

- your current age (if you need to check your birth certificate, do so now)

- your retirement date (you might want to check with your employer to see if you have a contractual or estimated retirement date, if you stay in the same job)

- your current 401k balance (most plans allow you to check this information online – see if you have the password!)

- your monthly 401k contribution (check your latest paycheck – and don’t forget to include any employer matching)

If you aren’t sure about any of these items, your human resources department can help you with this information, though at many companies you can find this online or on your paycheck confirmation slip.

Understanding the App

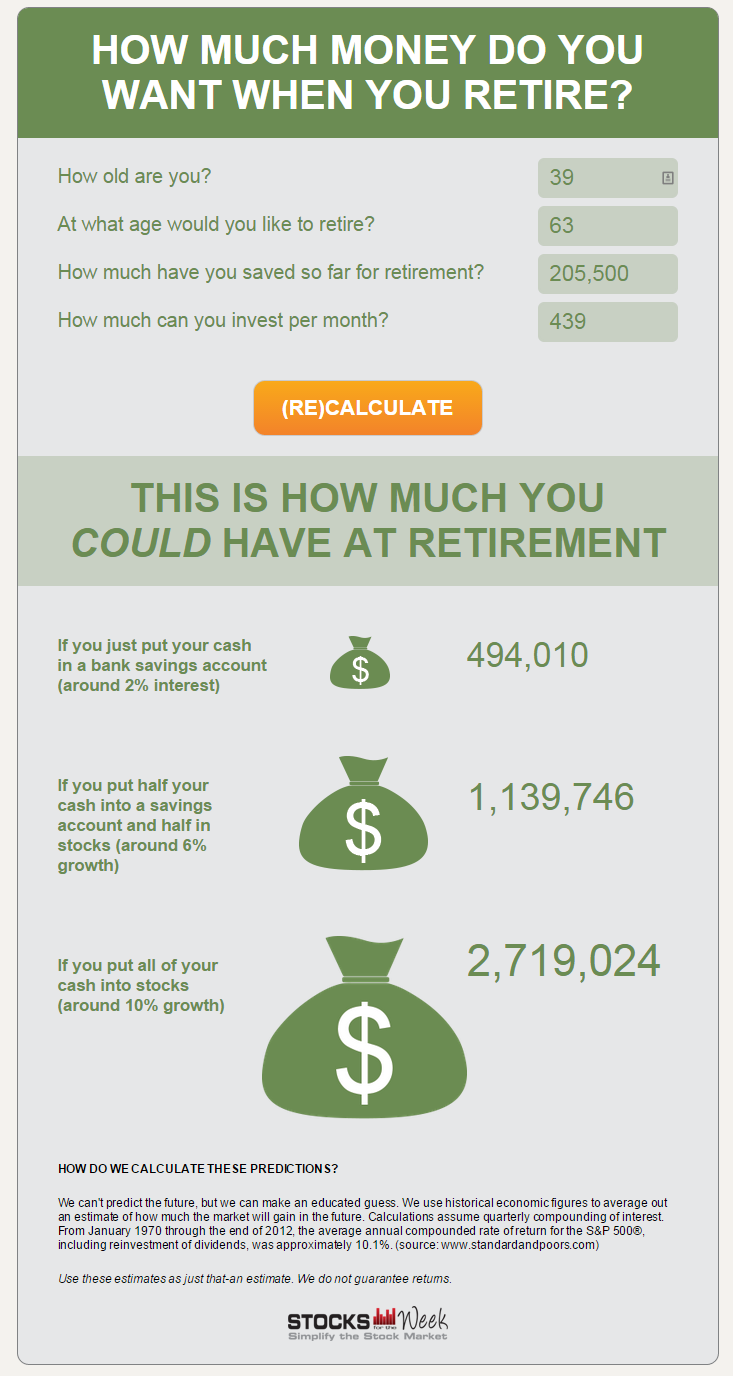

Once you have those for pieces of information, that’s what you’re going to want to put into the wealth calculator. Take a look at the screenshot below as an example that demonstrates:

- Your Current Age: 39

- Your Retirement Date: 63

- Your Current 401k Balance: $205,500

- Your Monthly 401k Contribution: $439

You’ll want to check in again about your current 401k asset allocation to determine which of the results from the wealth calculator can expect. Again, human resources can help you with this. If your 401k is only in cash, then the lowest number is what you might expect. If your 401k is all in stocks and bonds, the higher number is what you might expect.

Caveats

The wealth calculator reflects only a snapshot of the current situation, projected into the future our best guess estimates of future growth potential.

There are a lot of scenarios that could dramatically affect your actual retirement funds, such as:

- your employer adds/removes employer matching funds

- your salary goes up/down and you change your monthly contribution accordingly

- you decide to retire earlier/later

- unpredictable bank rates and market performance

The best way to use the wealth calculator is to allow it to get a sneak peek of the future, and adjust your current investing habits accordingly. We encourage you to try several different scenarios so you can see how the effects of your decisions compound over the days and months and years.