One of our most popular features to date is our online calculator which was originally conceived to help our users plan retirement scenarios, but we’ve found that forward-thinking stock investment planning is not just for retirement.

One of the biggest expenses one can have in their life is their mortgage payment and college – and today’s media isn’t shy to highlight the skyrocketing costs of college and the crippling loan payments many are facing once they graduate and again when buying a home. Many are also finding mixed results when seeing a salary that meets their expectations, so it’s important to think ahead financially. Our wealth calculator is not just for retirement – here are two other scenarios you might find interesting.

How to Use Our Calculator to Plan for College

While our calculator is geared towards retirement, you can use it to plan for college. Here’s how:

- How old are you: put in the current age of the student (even if they’re young)

- At what age would you like to retire: this is the age the student will go into college. For most this will be 18-20.

- How much have you saved / How much can you invest per month: answer these question normally, specifically for your college savings fund.

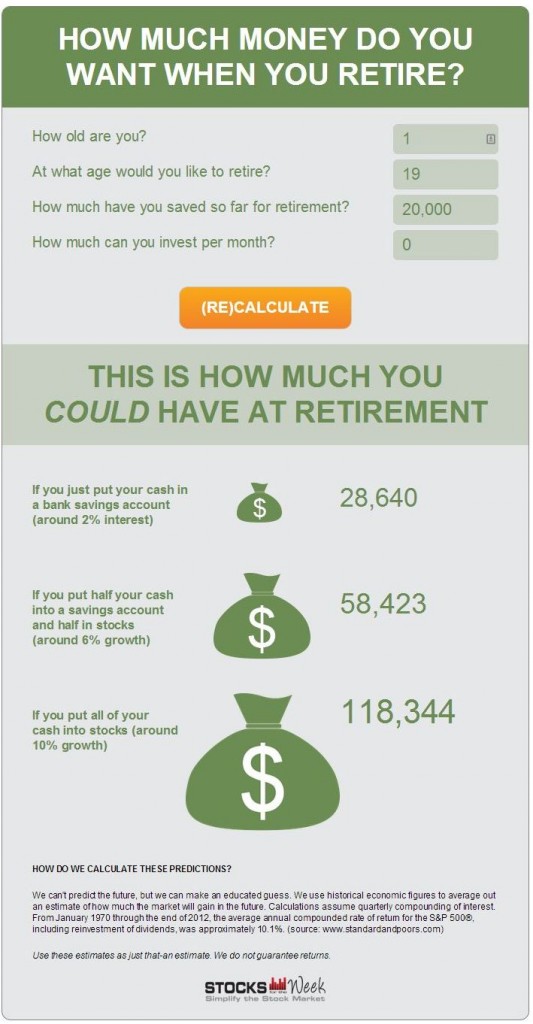

Let’s try this with an example. I found this article about creating a Roth IRA for a college fund very interesting, so let’s pretend we’re planning ahead for college.

Picture this: grandma and grandpa agree to start a fund at the child’s birth for their college – a $20k fund between everyone’s contributions, which may seem like a lot of money, and yet, it doesn’t stretch far enough in this day and age. What if they put that into savings versus stocks for 19 years, while NOT adding any additional money? The difference is stark:

How to Use Our Calculator to Plan for Your Weekend Home

If you weren’t graced with such forward-thinking grandparents, let’s try another scenario. One of my dreams is a weekend beach house. Since you may be like me and already have a house payment, in addition to most of those mid-life expenditures, can investing stocks make that beach house a little better?

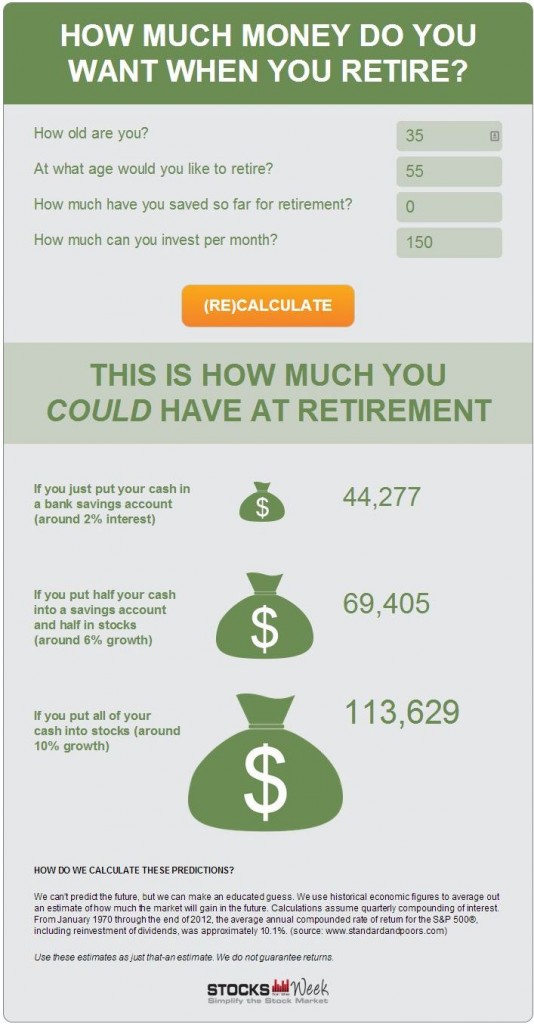

Let’s say we start our dream house fund at 35. And we want that getaway house a good 10-15 years before retirement, so let’s go with age 55. And we don’t want to spend too much per month, so we’ll say $150.

The results are clear – in just 20 years, stocks offer potentially twice as much of a down payment (and depending on how modest your weekend home dreams are, perhaps payment outright). You can adjust these scenarios in various ways to plan real estate purchases.

What’s the downside?

There is a downside here that we’d have to highlight: our estimates for stock market returns are an average (specifically, 1970 to 2012 in our calculator). This means that your results may vary; for example, if the stock has a down year the year before the student is due to go into school, the amount of resulting funds may be low. Most advisors suggest keeping an eye out a couple of years ahead of where you need your funds and if you’ve gotten excellent returns, move a portion of your funds back into stable cash savings to protect yourself.

Our calculator can help you estimate and model scenarios, but we can’t predict the future. When in doubt, consult with your financial advisor.